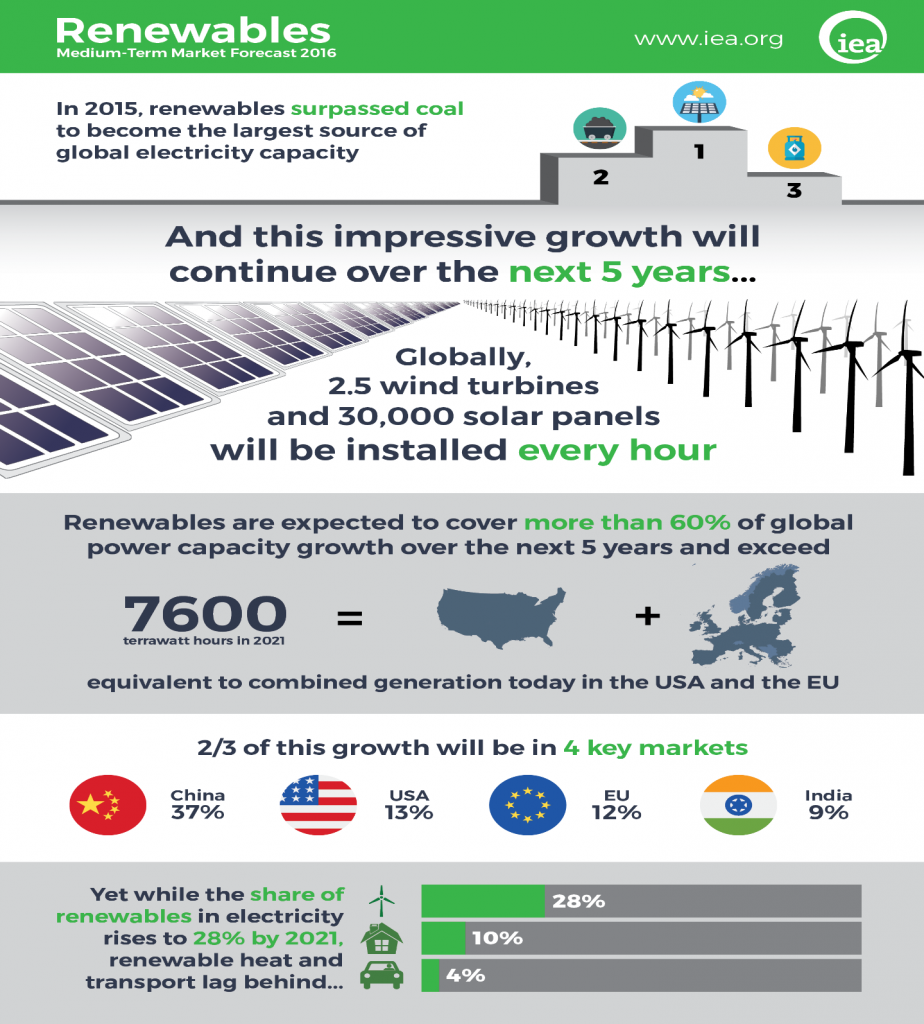

AS GLOBAL ENERGY DEMAND INCREASES RENEWABLE ENERGY IS PLAYING AN EVER-INCREASING ROLE

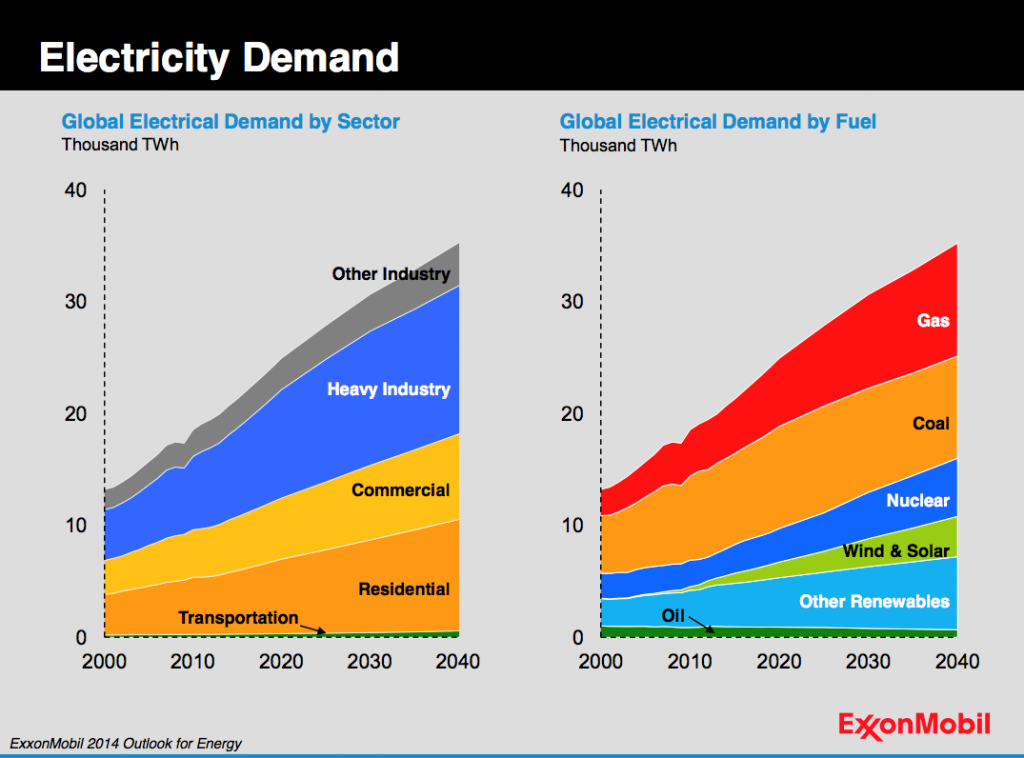

MORE DEMAND FOR GLOBAL ELECTRICITY

Charging Infrastructure Is a $2.7 Trillion Barrier to Electric Cars

Making sure that there’s always somewhere to juice up your ride is going to be big business. That’s according to financial services firm Morgan Stanley, which, according to Bloomberg, estimates that the world will need to spend a dizzying $2.7 trillion on charging infrastructure if it’s to support 500 million electric vehicles. (That may sound like a lot of cars and trucks, but it’s worth noting that there are over a billion on our roads right now. So even if robo-taxis erode the number of cars in city centers and autonomous trucks cut the number of 18-wheelers we need to run, it’s not a crazy number.)

The rollout of charging points is often cited as a key incentive to convince a public with range anxiety to adopt electric vehicles. Without a place to charge in a city center or, more important, beside a long and lonely highway, nobody would take the plunge and buy an electric car. In turn, that would render impotent even the most ambitious of regulatory pushes to incentivize automakers to build electric vehicles.

So far, building out a suitable network has seemed to require both private and public investment. We’ve already seen that to be the case, with the likes of Tesla building its own charging stations and the U.S. government committing to build a series of national electric-vehicle charging corridors around the country.

That will continue to be the case. But with such a huge amount of money potentially there for the taking, we may expect to see some more original thinking about the best ways to build and run charging points. After all, there’s nothing like the prospect of a fistful of dollars to get the creative juices—and, with any luck, the electrons—flowing. So assuming 500 million Electric Vehicles will be on the road in 20 years, how much electricity is demand to charge these 500 million EV every day? The battery pack for the pure 100% electricity is anywhere from 24 KWH to 85 KWH let just take the lower end of the range around 30 KWh, here are the electricity demand every day for these 500 million EV:

500,000,000 EV x 30 KWh = 15,000,000,000 KWh/day = 15,000,000 MWh/day = 15,000 GWh/day = 15 TWh/day

The estimated annual electricity consumption for 500 million EV will equal to:15 TWh/day x 365days= 5,475 TWh/Year.

How Big is this numbers (5,475TWh/Year?) Here is the actual annual report from the U.S. Energy Information Administration: for 2016 the total U.S. power generation is (4,076.8 TWh). WOW, INCREDIBLE!!!

So as we can see the total power demand for the 500 million EV worldwide will be BIGGER than the entire US power generation output per year!!! That is incredible, talking about the future demand for electricity beyond our imagination!!!

MORE DEMAND FOR GLOBAL ENERGY BECAUSE OF CRYPTOCURRENCIES MINING

Cryptocurrencies global market capitalization has surpassed $500 billion USD rising over 2000% in 2017. This trend is expected to continue for the foreseeable future as businesses increasingly embrace the elegant design and transparency the blockchain offers to all.

However, as of December 2017, Bitcoin mining energy intake has officially surpassed the entire energy consumption of Denmark. As the difficulty of mining increases to reflect the influx of miners joining the network, this energy consumption will increase.

The most astounding aspect of this is that the rate of expansion is exponential. At the current rate of consumption, next year Bitcoin mining will consume enough energy to be listed as the twentieth country in the world by energy consumption. The model is simply unsustainable. The world relies primarily on the production of energy from the burning of coal and oil, which not only damages the environment, but the economy as a whole. If Bitcoin has a great enough impact on the world’s coal and oil supplies, the cost of a kilowatt will rise globally.

The more valuable one bitcoin becomes, the more energy will be used to mine that coin, therefore with price spikes, come energy spikes. This will go on until energy around the world will cost much more than it does currently, as a result of increased demand from miners globally.

KEY NETWORK STATISTICS |

BITCOIN |

ETHEREUM |

| Network’s current estimated annual electricity consumption* (TWh) |

37.02 | 10.55 |

| Annualized global mining revenues | $19,107,870,821 | $7,125,662,989 |

|

Annualized estimated global mining costs |

$1,850,968,079 | $1,265,551,175 |

| Country closest to in terms of electricity Consumption | Qatar | Georgia |

|

Electricity consumed per transaction (KWh) |

262 | 33.00 |

| Number of U.S. households that could be powered in a year | 3,427,719 | 976,506 |

| Number of U.S. households powered for 1 day by the electricity consumed for a single transaction | 8.85 | 1.12 |

| Bitcoin’s electricity consumption as a percentage of the world’s electricity consumption | 0.17% | 0.05% |

| Annual carbon footprint (kt of CO2) |

18,139 | – |

| Carbon footprint per transaction (kg of CO2) |

128.35 | – |

Data as of December 25, 2017. Data provided by Digiconomist Energy Consumption Index. https://digiconomist.net